Table of Contents

- The FOMC - Timing Is Everything | Seeking Alpha

- [경제투자꿀팁]2021년 FED연준 FOMC 보는 방법(일정/라이브/내용/결과) : 네이버 블로그

- FOMC

- September FOMC meeting: Ramming home the higher for longer message ...

- Belajar Mengenal The FED dan FOMC - Lab Forex

- FOMC Gradually Lifts Funds Rate - Haver Analytics

- No Rate Hike Expected As FOMC Wraps Up Meeting Today

- FOMC_Federal_Reserve

- No Rate Hike Expected As FOMC Wraps Up Meeting Today

- 信息技术 2016-12-14 Drausio Giacomelli、Hongtao Jiang、Jed Evans 德意志银行 键***

Economic Growth Projections

![[경제투자꿀팁]2021년 FED연준 FOMC 보는 방법(일정/라이브/내용/결과) : 네이버 블로그](https://mblogthumb-phinf.pstatic.net/MjAyMTA2MTVfMjcz/MDAxNjIzNzU4NzQ1Njk1.cV7---FrGiIadztHbUjNC40d7KkPfCYZrcFQIOo3YRsg.rguEaqt126jfY8tEk9_NEti9PsGCb-Q8GcU86nFVxkMg.PNG.ventana89/image.png?type=w800)

Unemployment Rate Projections

Inflation Projections

Inflation is another key area of focus for the FOMC, and the March 2025 summary provides some insights into the Committee's expectations. The median projection for inflation, as measured by the personal consumption expenditures (PCE) price index, is 2.0% in 2025. This is slightly higher than the 1.9% projected in the previous summary, reflecting the ongoing impact of supply chain disruptions and other factors.

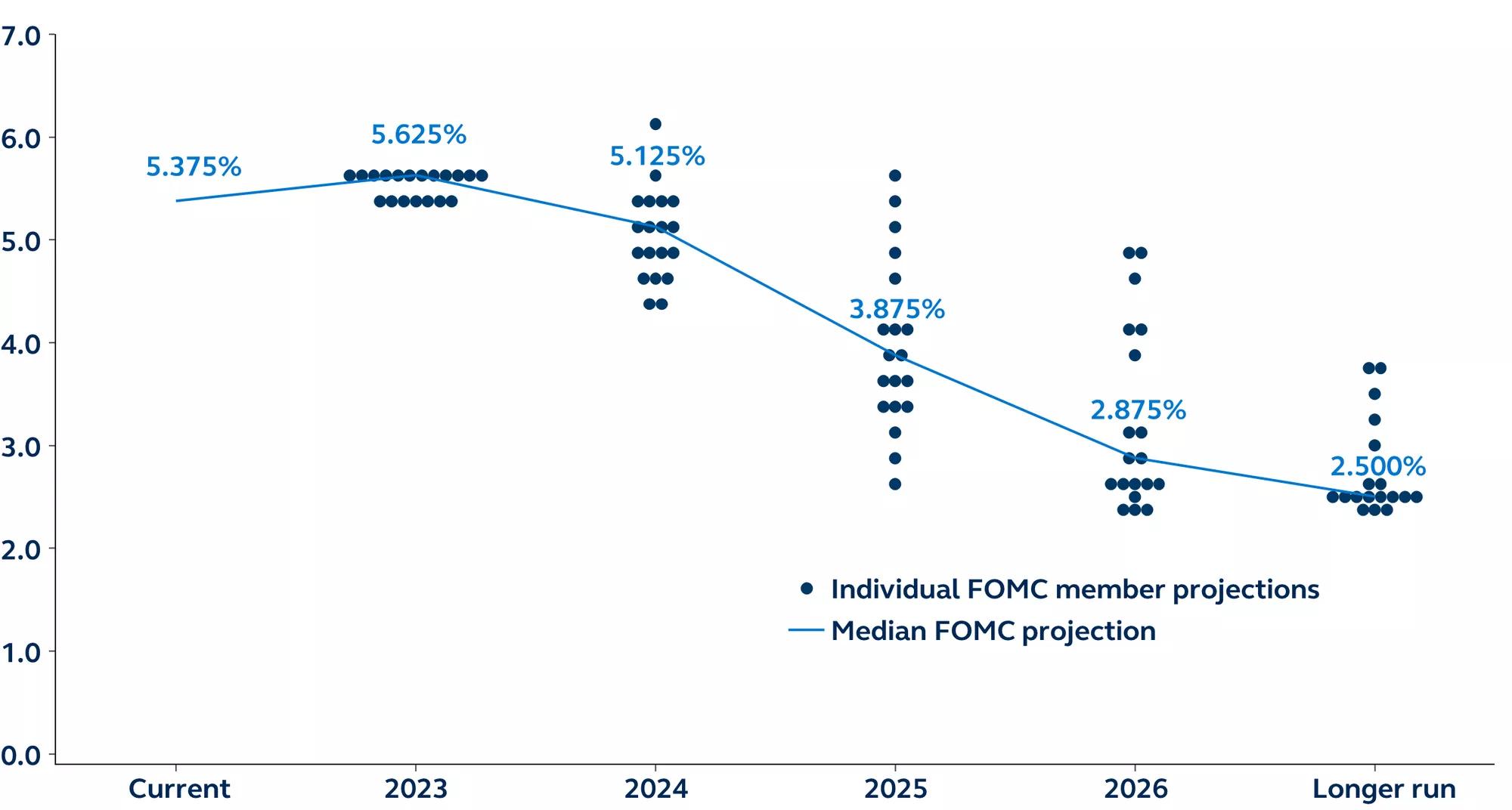

Interest Rate Projections

The FOMC's interest rate projections are always closely watched, as they have a significant impact on the economy. According to the March 2025 summary, the median projection for the federal funds rate is 1.9% in 2025, which is slightly higher than the 1.6% projected in the previous summary. This suggests that the FOMC expects to continue gradually raising interest rates to keep the economy growing at a sustainable pace. The March 2025 FOMC Summary of Economic Projections provides valuable insights into the Federal Reserve's economic outlook. While the economy is expected to continue growing, the pace of growth is expected to be moderate, and the labor market is expected to remain strong. Inflation is expected to remain low, and interest rates are expected to continue rising gradually. These projections have important implications for businesses, investors, and individuals, and will be closely watched in the coming months.For more information on the FOMC Summary of Economic Projections, visit the FRED Blog. The FRED Blog provides timely and informative articles on economic trends, data releases, and other topics related to the US economy.

Note: This article is based on the data available up to March 2025 and is subject to change as new data becomes available. The projections and forecasts mentioned in this article are based on the FOMC's Summary of Economic Projections and are subject to uncertainty and revision.